Fintech is projected to be a $1.5 trillion trade by 2030, a significant power within the international financial system. Latin America and the Caribbean is an important point of interest for the sector: Whereas lower than one in 10 folks worldwide dwell within the area, round one in 4 fintechs are based mostly there. Amongst these, Galgo stands out as a outstanding instance, showcasing the feasibility of attaining progress ranges which can be in step with the trade’s potential, whereas additionally producing significant affect for its end-users. Its success exhibits that fintech firms can obtain sturdy monetary returns and affect on the similar time.

Previously referred to as Migrante (migrant in Spanish), Galgo was initially based in Chile in 2018 to serve the rising diasporas of low-income, underbanked Latin American immigrants with revolutionary monetary providers that enabled them to get established and combine into their host nations. Galgo has since expanded its choices to achieve wider populations, specializing in offering low-income people and the rising center class with financing for the acquisition of bikes by way of its digital platform. This enterprise mannequin has enabled it to spice up monetary inclusion whereas additionally offering bikes to prospects who couldn’t in any other case afford them, giving them a supply of earnings era and thereby enhancing these shoppers’ high quality of life. It has additionally allowed Galgo to rapidly turn out to be a regional fintech powerhouse, increasing first to Peru, then to Mexico — and lately coming into into Colombia following its acquisition of Crediorbe final 12 months.

The success of fintechs like Galgo is backed by funding corporations that strategically spend money on startups that serve the underbanked. Nonetheless, whereas monetary entry is essential, it doesn’t assure monetary inclusion or improved residing requirements — one thing that should be taken into consideration by each impact-focused startups and their buyers. That’s why two of Galgo’s buyers — Group Funding Administration (CIM), an institutional affect funding supervisor that gives strategic debt capital to help accountable innovation in lending, and Kayyak Ventures, a enterprise capital agency that invests in mission-driven entrepreneurs, primarily in Latin America — have taken steps to assist improve Galgo’s affect by understanding the expertise of its end-clients. To that finish, in 2023, they partnered with 60 Decibels, a worldwide affect measurement agency the place I lead LATAM progress, to instantly collect the experiences of Galgo’s shoppers. We performed 15-minute telephone interviews with a randomized pattern of those shoppers, 200 in Chile and 200 in Peru. These interviews revealed compelling insights into the corporate’s affect, and the significance of client-centric affect measurement within the broader fintech sector. I’ll share a few of these learnings beneath.

Why Prioritize Consumer-Centric Influence Measurement in Fintech?

Because the fintech trade expands, inserting the shopper’s perspective on the forefront turns into more and more essential, to make sure that fintech options are accountable and genuinely improve shoppers’ lives. As Bernhard Eikenberg, Head of Rising Markets Technique at CIM, explains, “accountability to all stakeholders, in the beginning to the end-users of fintech providers, stays on the high of [CIM´s] priorities. Measuring, monitoring and understanding the last word affect of fintech on its customers can solely be understood by taking a customer-centric method that delves into the expertise of the customers themselves, and the way the utilization of these providers has affected their lives and their communities over time.”

Specializing in the variety of loans offered or shoppers reached just isn’t sufficient for fintechs or their affect buyers: As an alternative, it’s important for each events to grasp how these providers affect shoppers’ lives, incomes and total high quality of life. This requires them to maneuver past the frequent observe of merely gathering output information. Provided that affect is multi-dimensional, actually understanding affect requires a mixture of each output and consequence information, together with insights and experiences from the attitude of end-clients. As Andres Pesce, CEO at Kayyak, places it, “this information has distinctive worth in serving to fintech firms be taught from what’s working and what’s not in order that they’ll maximize their affect. Finish-stakeholders’ insights additionally assist buyers higher perceive the efficiency of their portfolio firms and fantastic tune their very own screening, due diligence and monitoring.”

What we realized from client-centric measurement

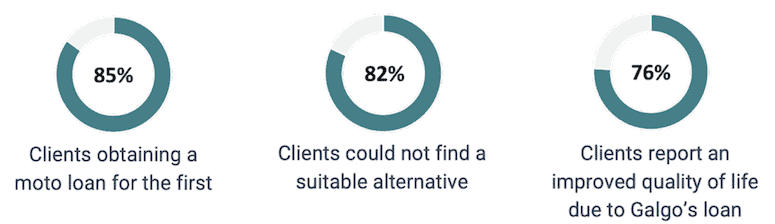

By facilitating monetary entry via motorbike loans, Galgo considerably improves its shoppers’ high quality of life. Impressively, we discovered that 85% of its shoppers are accessing this kind of mortgage for the primary time, surpassing the 60 Decibels’ Monetary Inclusion Benchmark for Latin America, which we set at 54%. This underscores Galgo’s capacity to achieve a shopper base that has been traditionally underserved by conventional monetary establishments.

Furthermore, we discovered that 82% of Galgo’s shoppers expressed difficulties find an appropriate different, additional emphasizing the fintech’s position in serving a comparatively underserved market section. The affect of this monetary entry is obvious: 76% of shoppers report an improved high quality of life as a result of Galgo’s mortgage and the motorbike buy it enabled, with decreased commuting occasions and improved entry to handy transportation being the highest self-reported outcomes.

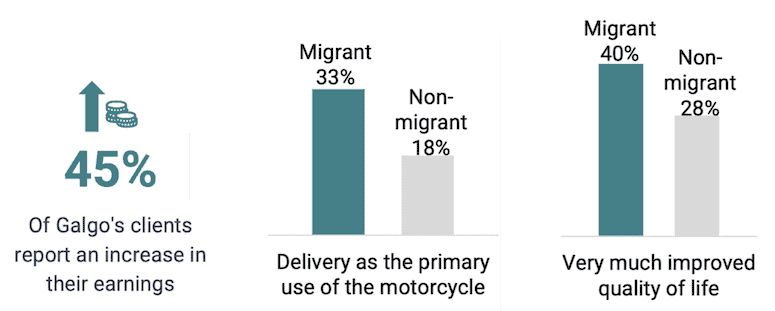

When it comes to earnings era, 45% of Galgo’s shoppers report a rise of their earnings after their buy. Notably, migrant shoppers are extra doubtless to make use of their bikes for earnings era, with 33% utilizing them for deliveries, in comparison with 18% of non-migrant shoppers. This results in variations in wellbeing enchancment: 40% of migrant shoppers report a “very a lot elevated” high quality of life as a result of Galgo’s providers, surpassing the 28% reported by non-migrant shoppers. This discovering factors the corporate towards potential areas the place it could possibly additional improve its affect, elevating questions like: Why are migrants reporting greater affect? What are the important thing drivers of this affect? And the way can it generate the identical stage of affect in non-migrant shoppers? The examine additionally gave Galgo the chance to establish challenges that, when addressed, can enhance person expertise and improve progress for the enterprise.

Placing Learnings Into Motion

By highlighting not solely its present affect but additionally areas for additional improvement, these learnings have offered Galgo with important data it could possibly use to refine and broaden its method. As Diego Fleischmann, co-founder and CEO of Galgo, explains, “these outcomes — endorsed by an impartial knowledgeable — verify our affect and objective, and present with granular information that our resolution solves a significant drawback in our prospects’ lives with sturdy potential to scale within the area. The examine permits us to higher perceive buyer conduct and real-life affect to proceed evolving our digital options.”

General, Galgo’s journey exemplifies the transformative potential of accountable fintech in enhancing the lives of underbanked people. The collaboration between Galgo, the affect funding corporations Kayyak and CIM, and 60 Decibels underscores the significance of measuring affect from a client-centric perspective. Because the fintech trade continues to evolve, the emphasis on enhancing the person expertise and selling monetary inclusion will likely be central to its success. To attain this, we have to begin gathering and analyzing end-client information to tell decision-making for each firms and buyers alike. That is the following frontier in inclusive fintech, and examples like this might help us establish how fintech firms and buyers can higher use affect information to enhance each revenue and affect.

Carla Grados-Villamar is a Supervisor at 60 Decibels and leads its Latin American progress.

Photograph by way of Galgo.