Displacement and migration permeate the historical past of humanity. For millennia, peoples have come and gone from their homelands, and far of that motion was compelled, whether or not by struggle, lack of meals or assets, or different elements. In any case, apart from a small minority of dreamers and explorers, when given the selection, most individuals favor to remain the place they’re, within the land of their beginning, amongst these they grew up with.

Displacement is — and has all the time been — part of the essential cycle of life. And so, because the function of finance is to assist folks navigate that cycle of life, it also needs to play an necessary function in addressing the big shocks and challenges of displacement.

That’s why e-MFP is happy to announce the launch of the European Microfinance Award 2024, which can deal with “Advancing Monetary Inclusion for Refugees & Forcibly Displaced Folks.” The purpose of this 12 months’s award is to spotlight organizations lively in monetary inclusion that assist forcibly displaced folks construct resilience, restore livelihoods, and stay with dignity of their host communities.

What’s compelled displacement?

In response to the United Nations Excessive Commissioner for Refugees (UNHCR), compelled displacement happens when people flee because of “persecution, battle, violence, human rights violations or occasions critically disturbing public order.” These people could embody refugees, asylum seekers and internally displaced folks. Different interpretations are broader: As an example, the World Partnership for Monetary Inclusion additionally contains pure disasters and local weather change as drivers of compelled displacement. These are finally authorized and definitional questions, however the underlying concept is similar: When folks migrate out of necessity moderately than selection, they turn into forcibly displaced folks, or FDPs.

It is a rising world phenomenon, with over 108 million folks worldwide estimated to be forcibly displaced on the finish of 2022. Furthermore, whereas folks fleeing to rich locations just like the U.S. or EU international locations obtain a lot of the worldwide media protection, most FDPs are both internally displaced (58%) or search refuge in neighbouring international locations (70% of cross-border FDPs). In consequence, three out of 4 FDPs are situated in low- and middle-income international locations.

With rising world uncertainty and proliferation of the assorted causes of displacement, these figures are more likely to improve additional. Furthermore, displacement has turn into extra protracted and sophisticated in nature, usually involving a number of actions each inner and exterior to the nation of origin, with displacement camps or cities as the most typical locations. Such compelled displacement impedes the achievement of the UN’s Sustainable Growth Targets (SDGs) and different worldwide commitments to respect human rights and supply safety, help and growth to susceptible populations.

Monetary inclusion for refugees and FDPs

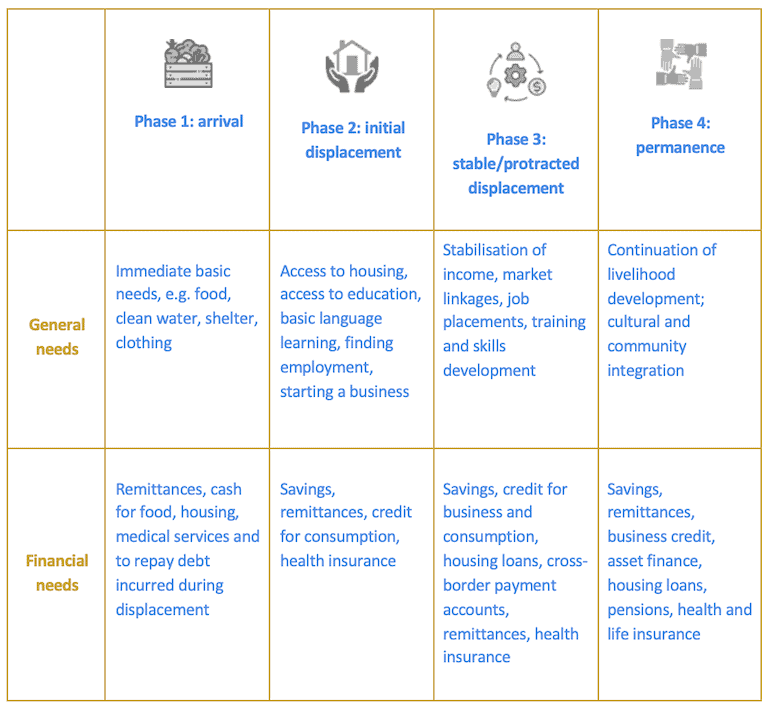

FDPs face distinctive wants and vulnerabilities, requiring the difference of current (or the creation of recent) monetary and non-financial services and products. Monetary service suppliers (FSPs) should additionally work with accomplice organizations and host group teams to assist FDPs in constructing resilience, restore FDPs’ livelihoods, assist them stay with dignity in host communities, and — when applicable — facilitate their return or resettlement. In response to the UNHCR-Social Efficiency Activity Drive report “Serving Refugee Populations – The Subsequent Monetary Inclusion Frontier: Pointers for Monetary Service Suppliers,” FDPs’ wants sometimes fluctuate in line with the section of their displacement:

Supply: Tailored from UNHCR-SPTF – Serving Refugee Populations – The Subsequent Monetary Inclusion Frontier: Pointers for Monetary Service Suppliers

Every section entails completely different monetary wants and monetary companies. These don’t all the time require suppliers to supply a separate suite of economic services and products aimed particularly at FDPs, however they do require them to know that FDPs embody a various vary of teams and people, with vastly completely different wants relying on their origin, language and section of displacement. And past these, the wants of FDPs differ significantly based mostly on who they’re themselves: Girls refugees, for instance, have explicit wants that relate to problems with gender-based violence and sociocultural norms which will restrict their monetary independence, amongst others.

Addressing the obstacles to the monetary inclusion of FDPs

Whereas understanding the wants of FDPs is necessary, recognizing — and addressing — the obstacles they face is the larger and extra important problem. These obstacles match into 4 essential classes: familiarity obstacles that include not figuring out the native language or practices, or the completely different companies obtainable; “newcomer” obstacles that include being a current arrival, comparable to the dearth of a monetary observe document, viable mortgage collateral or different monetary assets; authorized obstacles, such because the absence of authorized standing, lack of applicable identification to satisfy Know Your Buyer (KYC) necessities, or restrictions on motion (comparable to being in a refugee camp); and eventually, cultural and political obstacles that come from host communities viewing arrivals with suspicion or bias.

Addressing these obstacles is the place monetary service suppliers and the broader monetary sector could make the most important distinction for FDPs. To deal with familiarity obstacles, suppliers could make modifications of their gross sales and outreach channels to make FDPs really feel welcome and make their companies extra accessible. This may be accomplished by means of proactive efforts to achieve out to FDP communities, offering data of their language, and hiring workers or representatives from these communities themselves.

To deal with the “newcomer” obstacles, FSPs can deal with conventional microfinance methods of constructing a credit score historical past from scratch or utilizing guarantors as a substitute for collateral. They will even search to get better FDPs’ misplaced credit score historical past by getting access to credit score data from the purchasers’ house international locations. No much less importantly, suppliers can deal with non-credit merchandise that may assist facilitate FDPs’ settlement into a brand new group, comparable to efficient and cost-efficient fee and remittance companies, in addition to applicable insurance coverage and financial savings.

For FSPs that intention to serve these purchasers, the authorized obstacles could seem insurmountable, and a few actually are. However authorized obstacles could generally be extra versatile than they appear. For instance, KYC rules that require FSPs to gather figuring out details about the shopper are sometimes interpreted to require particular varieties of ID that FDPs could not have. However a extra versatile strategy that enables different — however no much less legitimate — types of ID can usually meet authorized KYC necessities utilizing paperwork FDPs usually tend to possess.

Monetary establishments could make a number of the most significant progress in assembly FDPs’ wants by addressing cultural and political obstacles. Longstanding establishments have deep ties to their very own communities — they make use of tons of and even hundreds of workers and serve even bigger numbers of purchasers. By specializing in messages that handle the widespread biases and unfavourable stereotypes of FDPs, suppliers can play a key function in bringing down these partitions. In any case, profitable FDPs who construct native companies and contribute to the native financial system will be a number of the simplest messengers of the worth that FDPs deliver to the host group — and establishments which have purchasers in each the FDP and host communities are glorious automobiles for channelling this message.

Lastly, guaranteeing efficient monetary inclusion usually requires complementary non-financial companies — for example, monetary literacy coaching and native cultural sensitization, mentorship, language classes, and paralegal companies, amongst many others. Many of those companies are past the capability of economic establishments, and require them to accomplice with NGOs, worldwide refugee organizations such because the UNHCR and others, in addition to native authorities and group organizations. And partnerships don’t cease there: Suppliers can work collectively by way of business associations and networks to have interaction with regulators to deal with authorized obstacles (comparable to KYC necessities), and in addition to have interaction with the broader policymaking group — for instance, to advocate for short-term or fast-track enterprise registration or work permits for certified refugees.

Inclusive finance organizations can and do play an necessary function in bettering the lives of forcibly displaced folks. We hope that the European Microfinance Award 2024 will spotlight these contributions and showcase the constructive influence the sector can have on this urgent concern.

The European Microfinance Award 2024

The European Microfinance Award 2024 on “Advancing Monetary Inclusion for Refugees & Forcibly Displaced Folks” was launched on March 14. It seeks to spotlight organizations lively in monetary inclusion that assist forcibly displaced folks construct resilience, restore livelihoods, and stay with dignity of their host communities.

To be eligible, organizations should be lively within the monetary inclusion sector, absolutely operational for at the very least two years, and based mostly and working in a Least Developed Nation, Low Revenue Nation, Decrease Center Revenue Nation or Higher Center Revenue Nation, as outlined by the Growth Help Committee Checklist of ODA Recipients.

The decision for first-round functions is open till April fifteenth, and the multi-stage analysis course of will culminate with the winner of the €100,000 prize (plus the 2 runners-up, who every win €10,000) being introduced throughout European Microfinance Week in November. All finalists and semi-finalists might be featured within the annual e-MFP Award publication and might profit from an unlimited quantity of constructive publicity over the course of the method. All data on the subject, eligibility necessities, and software and analysis processes will be discovered on the European Microfinance Award web site.

With a view to reply to any questions that applicant organizations could have when making use of to the Award, e-MFP is organizing three Software Steerage periods: an English session on March twenty fifth (register right here); a French session additionally on March twenty fifth (register right here); and a Spanish session on April third (register right here). We sit up for receiving functions from a various array of organizations within the monetary inclusion sector.

NOTE: The European Microfinance Award was launched in 2005 by the Luxembourg Ministry of Overseas and European Affairs — Directorate for Growth Cooperation and Humanitarian Affairs. It’s collectively organized by the Ministry, the European Microfinance Platform (e-MFP), and the Inclusive Finance Community Luxembourg (InFiNe.lu), in cooperation with the European Funding Financial institution (EIB).

Sam Mendelson is a Monetary Inclusion Specialist, Fernando Naranjo is a Program Coordinator, and Daniel Rozas is a Senior Microfinance Skilled at e-MFP

Picture courtesy of e-MFP.